As a result of growth in the US markets, WaiverForever is now required to register and collect sales taxes in various states across the US.

Starting from March 1st, 2022, WaiverForever will begin collecting state and local sales tax if your billing address is in the Washington state. WaiverForever collects tax based on your billing address, regardless of which currency you pay in. The prices displayed on waiverforever.com don’t include sales tax or value-added tax because each country and region charges a different tax rate.

To check your tax rate, please visit https://www.taxjar.com/sales-tax-calculator .

Why are you charging sales tax now?

WaiverForever is required to collect sales taxes in certain states based on that state’s tax laws. For that reason, we will now begin collecting sales tax in certain states where we have customers.

How much will I have to pay?

The sales tax you will be charged will be the applicable sales tax rate in the area/county where you are located. We are currently charging the sales tax based on the billing address you have on file with us.

To check your tax rate, please visit https://www.taxjar.com/sales-tax-calculator .

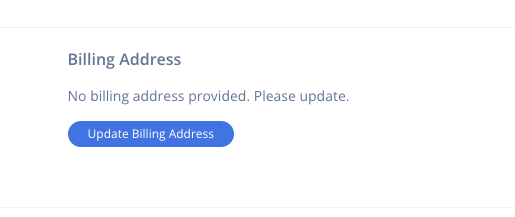

To update your billing info, please sign in at https://www.waiverforever.com and visit https://app.waiverforever.com/plan_and_billing . Then click the “update billing address” button.

Why didn't I have to pay it before?

Tax laws and their application change from time to time, and we are required to collect taxes in some states, particularly where we have a lot of customers. Our engineers have been working on our tax collection system and in the meantime we have been paying these taxes on your behalf. Now we are ready to begin collecting sales tax from customers in the applicable states.

Where do I see sales tax charges on my invoice?

When sales tax is charged, it will appear as a separate line on the invoice.

What do I need to do if I am tax exempt?

If your company or non-profit organization is exempt from sales tax in your country or region, you can contact us to submit proof of your tax-exempt status to have tax removed from all future invoices.

For US customers, we will need your signed tax exemption certificate*.

* 501(c)(3) status from the IRS is not sufficient proof of state or city sales tax exemption. Make sure to provide the exact business entity name in your billing info and add WaiverForever to your tax exemption certificate before you submit it:

WaiverForever

AriesApp, Inc.

800 Bellevue Way NE, STE 500

Bellevue, WA 98004